31+ Conventional 97 loan calculator

Loan volumes grew so quickly that Freddie Mac tightened lending criteria in 1984. During the same time period total solar.

![]()

The Measure Of A Plan

Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan.

. Get all the latest India news ipo bse business news commodity only on Moneycontrol. Chart represents weekly averages for a 30-year fixed-rate mortgage. To qualify for a conventional loan most lenders prefer a credit score of 680 or higher.

It allows you to access some of your home equity without having to move or sell. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. With each subsequent payment you pay more toward your balance.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Benefits of using our Reverse Mortgage Calculator. Using our calculator above.

A reverse mortgage is a loan secured by your home. Fannie Mae has approved mortgage lenders to offer a HomeReady lending program that only requires a 3 down-payment. Though in certain cases some conventional lenders may approve a credit score as low as 620.

Rates are influenced by the economy your credit score and loan type. 3 is the minimum for a 97-3 loan. Need to generate an amortization schedule for a 30 year fixed-rate conventional loan.

30 Year Fixed Rate Mortgage Loan Calculator. Use our calculator above. The average mortgage interest rate is around 55 for a 30-year fixed mortgage.

A conventional loan is classified as a conforming conventional loan when it falls under prescribed financing limits prescribed by the Federal Housing Finance Agency. Easy to use. But ideally you should aim for a score of 700.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. This lets us find the most appropriate writer for any type of assignment. Fixed-rate 10-year Home Loan Calculator.

Mortgage loan basics Basic concepts and legal regulation. March 31 2022 - 19 min read. It is called reverse because instead of a conventional mortgage in which you have to pay your bank a reverse mortgage pays you.

Should be 31 or lower. This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate. 699 to 2273 with autopay.

Rates for the HomeReady loan might be even lower than for other low-down-payment mortgages like the 3 down conventional 97 loan. Historical mortgage rates chart. Comparing USDA Loans Conventional Mortgages.

On regular conventional conforming mortgages private banks offer funding and typically prefer borrowers that pay 20 down payment of the homes. Loans with a 3 down-payment are called Conventional 97 mortgages. Conventional loan providers usually approve a FICO credit score of 680.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. A guide to better understanding closing costs is. Estimate your monthly loan repayments on a 200000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

If you are seeking a loan for a format without a front-end limit you can set the front-end box to 100 for 100. Costly total MIP compared to PMI on conventional loan which is removed once you have over 20 home equity. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

The program can be used by first-time repeat home. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The first tab offers an advanced closing cost calculator with detailed and precise calculations while the second tab offers a simplified closing cost calculator which shows a broader range of estimates.

In 1983 39 billion in additional stock was added. Estimate your monthly loan repayments on a 300000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Solar power includes utility-scale power plants as well as local distributed generation mostly from rooftop photovoltaics and increasingly from community solar arrays.

Get 247 customer support help when you place a homework help service order with us. The third tab shows current Boydton mortgage rates to help you estimate payments and find a local lender. With each subsequent payment you pay more toward your balance.

Interest Only Conventional Calculator This allows for a loan of a certain length where the first few years are interest only with a reduced payment and the balance is then amortized out to a standard conventional fixed rate loan for the remainder of the loan term. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

For conventional loans the front end-DTI limit is 28 while the back-end DTI is 43 but this can be as high as 50 if you have compensating factors. As of 2022 Congress set the conforming loan limit for single unit homes across the continental United States to 647200 with a ceiling of 150 that amount in areas where median home. By 1984 ARMs accounted for about 60 of new conventional mortgages closed that year exclusive of FHA VA loans.

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

From January through December 2021 utility-scale solar power generated 1147 terawatt-hours TWh or 279 of all generated electrical energy in the United States. Typical banks want at least a 3 down-payment PMI to insure loans. Company Company - Logo Minimum credit score Current APR range Loan amounts Learn More CTA text Learn more CTA below text LEARN MORE.

Average for 2022 as of August 26 2022.

The Loan Process Mortgage Loan Originator Mortgage Loans Mortgage Payoff

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

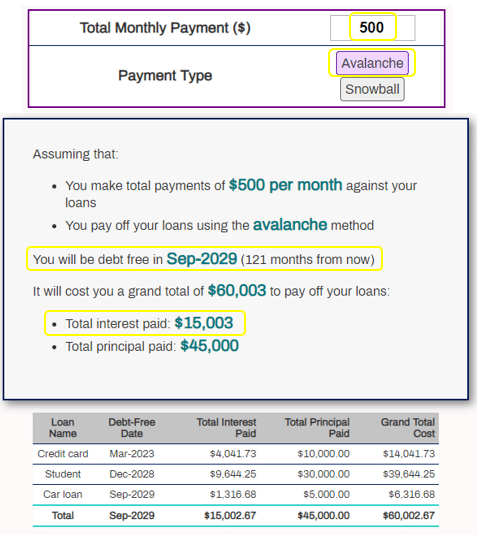

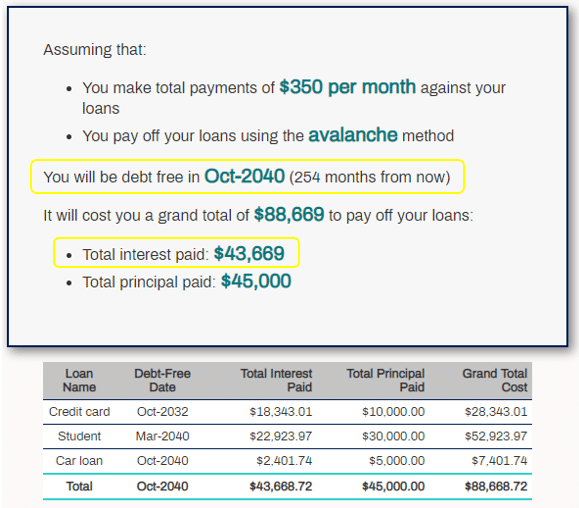

The Measure Of A Plan

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

The Financial Budget Manual By Aginfo Issuu

The Measure Of A Plan

The Measure Of A Plan

Hey I Found This Really Awesome Etsy Listing At Https Www Etsy Com Listing 843902933 1 Punto De Cruz Patrones Patrones De Puntos Patrones De Encaje De Aguja

Feel Free To Customize And Post These Free Real Estate Social Media Posts As You Like All Are Size Real Estate Quotes Real Estate Tips Real Estate Infographic

The Measure Of A Plan

4 Factors Affecting A Small Business Loan Bestsmallbusinessloans Smallbusinessfunding Smallbusine Small Business Loans Business Loans Small Business Funding

Skoog Analytical Chemistry 9e Pdf Titration Chemistry

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Did You Know That Just By Adding Color Visuals To Their Text Researchers Were Able To Increase Their Audience S Willi Buying First Home Real Estate Home Buying

Fixed Or Arm Mortgage Mortgage Infographic Mortgage Loan Originator

Design Regas Interiors Photo Woodie Williams Luxury Interiordesign Livingroom Fire Traditional Design Living Room Minimalist Living Room Elegant Living Room

Fha Vs Conventional In 2022 Homeowner Quotes Private Mortgage Insurance Money Management Advice